News & Insights

SEIS Vs EIS Explained: What’s The Difference & Why Should Early Stage Businesses Want To Know?

The first thing any investor or founder says after hearing about SEIS or EIS for the first time is: ‘Great news!’

The potential for tax relief and early-stage funding makes this scheme incredibly attractive not just for investors but for founders as well. And we can see why.

New ventures receive funding, risk-taking investors see returns, and the UK economy benefits from a surge of fast-growing companies. It’s a win-win for everyone! The uptake has also been significant. In the tax year 2022 to 2023, 4,205 companies raised a total of £1,957 million under the EIS scheme, while 1,815 companies raised £157 million through SEIS funding.

And now, in the 2024 Budget, the UK government has announced that the EIS and SEIS are here to stay with both schemes being extended for a further 10 years to April 2035.

But if you’ve already heard about either of these schemes, the next question probably running through your mind is: what’s the difference between the SEIS and EIS schemes?

This article will answer this question.

But just in case you weren’t wondering this at all and you, in fact, are just hearing about these schemes for the very first time, we’ll take a few steps back and start with the basics.

What is SEIS?

The Seed Enterprise Investment Scheme (SEIS) is a UK government initiative focused on encouraging investment in very early-stage companies. It provides investors with significant tax reliefs, including 50% income tax relief on investments up to £100,000 per tax year.

SEIS companies must be very small and young, with less than £200,000 in assets and fewer than 25 employees, making it particularly suitable for higher-risk, early investments in startups.

What is EIS?

The Enterprise Investment Scheme (EIS) aims to boost investment in slightly more mature, but still small, businesses by similarly offering tax relief to investors. EIS allows investors to support companies with up to £15 million in assets and up to 250 employees (or up to 500 for knowledge intensive companies), making it well-suited for businesses in growth phases seeking more substantial funding.

SEIS vs EIS: What’s the difference?

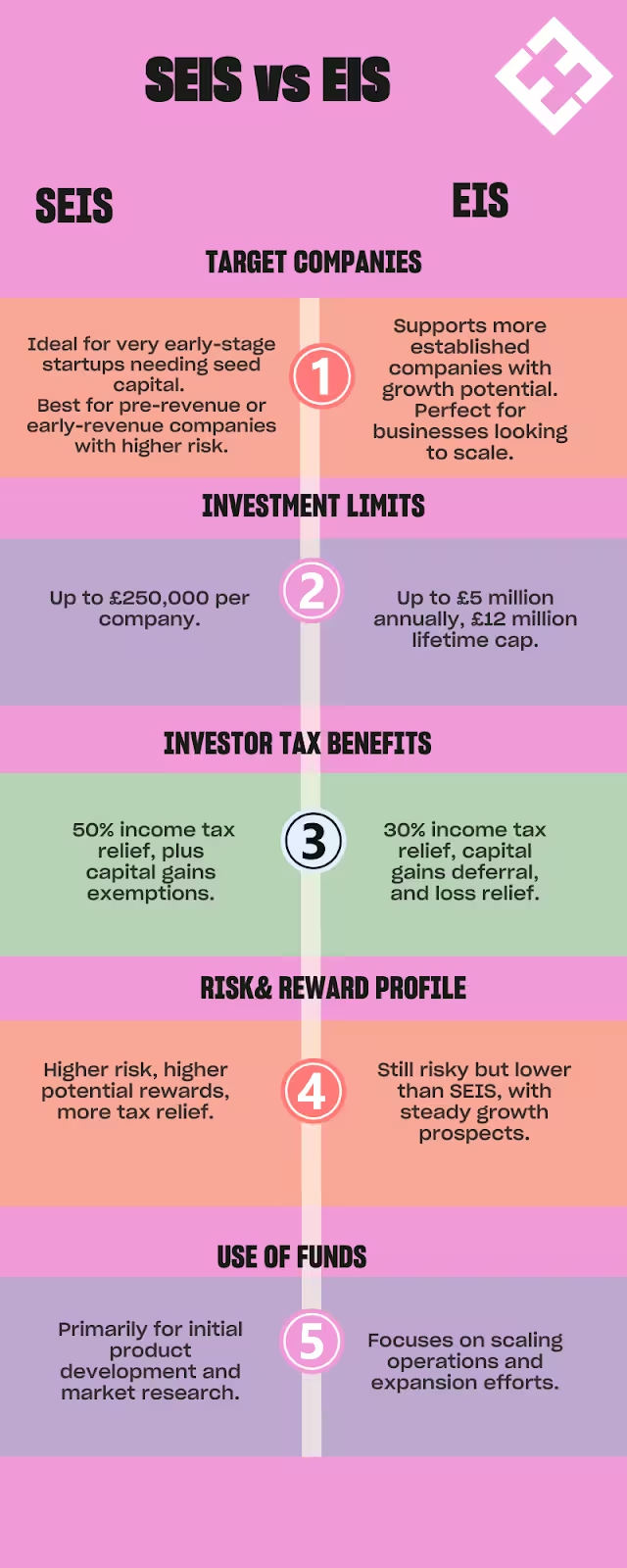

While SEIS and EIS share similar goals of stimulating economic growth and fostering innovation, they focus on different companies, have different investment limits, and come with different risks and rewards for investors. Here’s a quick look at the key differences:

1. Target Companies and Stage of Growth

As mentioned earlier, SEIS is designed specifically for very early-stage companies, typically those just starting out or in their first years of operation. This makes it ideal for startups that are looking for seed capital to get their business off the ground. The scheme is generally used by businesses that are pre-revenue or just starting to generate revenue.

EIS, on the other hand, is aimed at more established companies that may already have some traction or a product in the market but still need external funding to expand further. It caters to businesses that are in their growth phase, seeking additional capital to scale their operations, develop new products, or enter new markets.

2. Investment Limits for Companies

Under SEIS, a company can raise up to £250,000 in total, with a gross investment limit of £350,000 when combined with other schemes.

Alternatively, EIS allows companies to raise significantly more, with a yearly cap of £5 million (£10 million for knowledge-intensive companies) and a lifetime limit of £12 million (£20 million for knowledge-intensive companies).

3. Investor Tax Benefits

Both SEIS and EIS offer attractive tax reliefs, but the benefits under SEIS are more generous due to the higher risk associated with investing in very early-stage businesses. For SEIS, investors can claim 50% income tax relief on investments of up to £200,000 per tax year, along with exemptions from capital gains tax (50% CGT Reinvestment Relief) on any gains from SEIS shares.

This exemption is even more beneficial now that capital gains tax rates have increased, as announced in the Autumn Budget 2024. With higher taxes on profits from selling assets, the SEIS capital gains tax exemption allows investors to avoid these additional costs entirely on their SEIS returns.

N.B. And this is very important to remember: You must keep/hold your shares for at least three years to receive these tax benefits.

Additionally, SEIS shares are 100% exempt from inheritance tax (IHT) if held for at least two years.

With EIS, investors receive 30% income tax relief on investments of up to £1 million per tax year (or £2 million if at least £1 million is invested in knowledge-intensive companies). It also allows for capital gains deferral, meaning any gains can be deferred if reinvested in EIS-qualifying shares, along with the potential for loss relief if the investment does not perform well.

It’s also worth noting that just like SEIS, EIS provides 100% IHT exemption after two years, making it a valuable option for both risk mitigation and estate planning.

What types of companies are eligible for SEIS and EIS?

A company is eligible for SEIS if:

– It has fewer than 25 full-time employees.

– Its gross assets do not exceed £350,000 before receiving SEIS investment.

– It is less than 3 years old at the time of the SEIS investment.

– It is a permanent UK establishment and must carry out most of its business activity within the UK.

– It carries out a qualifying trade — most trading activities are eligible, but certain sectors are excluded, such as coal or steel production, banking, insurance, legal or accounting services, property development, and financial services.

A company is eligible for EIS if:

– It has fewer than 250 full-time employees (or 500 for knowledge-intensive companies).

– Its gross assets do not exceed £15 million before the EIS investment and £16 million after.

– It is less than 7 years old (or 10 years for knowledge-intensive companies) from its first commercial sale at the time of receiving its first EIS investment.

– It is a permanent UK establishment, and most of its business activities are carried out within the UK.

– It operates a qualifying trade, with similar exclusions as SEIS, such as banking, insurance, property development, and financial services.

– It has not exceeded the lifetime funding limit of £12 million from EIS and other venture capital schemes (or £20 million for knowledge-intensive companies).

How much can an investor invest under SEIS and EIS?

Under the Seed Enterprise Investment Scheme (SEIS), an individual can invest up to £200,000 per tax year, while the limit under the Enterprise Investment Scheme (EIS) is £1 million per tax year, or £2 million if at least £1 million is invested in knowledge-intensive companies. In both cases, the shares must be ordinary, non-redeemable shares with no preferential rights attached, ensuring that investors do not receive any special advantages over other shareholders.

There are also ownership restrictions: an investor cannot hold more than 30% of a company’s total shares, either directly or through associates. Additionally, investors cannot be connected to the company as employees to qualify for the tax reliefs offered by these schemes.

Directors, however, can invest under SEIS, and they can also qualify for EIS relief if they are unpaid. Paid directors may be eligible for EIS if they meet specific ‘business angel’ requirements, which often include taking a director position after the shares have been issued, though exceptions exist.

Can you raise SEIS and EIS at the same time?

Yes, a company can raise both SEIS and EIS funding, but there are specific rules about how this can be done. A company can’t raise SEIS and EIS for the same shares at the same time; however, it can structure its fundraising in a way that allows both types of investment.

The general approach is to use SEIS first and then move on to EIS. This means that a company can raise up to £250,000 under SEIS, and once that limit is reached, it can then raise additional funds under EIS, up to the £5 million per year limit that EIS allows. The SEIS shares must be issued and the SEIS limit must be reached before any EIS shares are issued.

This combination is beneficial for startups because it allows them to take advantage of the more generous SEIS tax reliefs at the earliest, higher-risk stage of their development. Once they have established some traction with the SEIS funding, they can then raise further capital using EIS to support their growth. By doing so, companies can attract a wider range of investors and maximise the funding available for their needs.

N.B. Before starting this process at all, it’s highly recommended to obtain advance assurance from HMRC. This gives investors confidence that the company is likely to qualify for SEIS and EIS tax reliefs, which can help secure their commitment.

What can a company use SEIS and EIS funding for?

Companies can use SEIS and EIS funding to help grow and develop their business, but there are rules about how the money can be spent to make sure it’s used for real business growth.

SEIS and EIS funding can be used for:

- Business growth and expansion: This includes activities like hiring new staff, expanding into new markets, scaling up operations, and opening new locations.

- Product development: Companies can use the funds to develop new products or services or to enhance existing offerings, which is especially common for tech startups or companies in the research and development phase.

- Marketing and sales: The funds can be allocated towards marketing campaigns, sales activities, and customer acquisition strategies to help increase the company’s reach and revenue.

- Research and development (R&D): Businesses, especially those in technology, life sciences, or knowledge-intensive sectors, can use the funding to conduct research, develop new technologies, or improve their existing offerings.

- Purchase of assets: Buying equipment, software, or machinery needed to run the business.

However, there are restrictions on the use of SEIS and EIS funding to ensure it is used for genuine business growth:

- Not for repaying existing debt: The funding cannot be used to pay off existing loans or financial obligations. The focus must be on future growth rather than covering past costs.

- No acquisition of shares: The funds cannot be used to acquire shares in other companies, ensuring that the investment directly benefits the growth of the company raising the funds.

- No property development: The funds cannot be used for property development, as this is considered a lower-risk activity and not aligned with the schemes’ goals of fostering innovation and growth.

Final thoughts

Now that you know the difference between SEIS and EIS, what’s your next step? Whether you’re a founder looking for the right funding option or an investor seeking new opportunities, understanding these schemes can help you make informed decisions — and unlock valuable tax benefits.

To support the growth of early-stage AI companies, we’ve recently launched a (S)EIS AI Growth Fund, designed to provide investors with access to high-potential startups while enjoying the tax reliefs highlighted in this article.

Find out more about our new S/EIS AI Growth Fund here.

Tags: EIS, Funding, Investors, SEIS, Tax relief

Join our community

As well as investing in and mentoring businesses, we’re creating a community of entrepreneurs, investors and technology enthusiasts.

Become part of the EHE community and benefit from:- Growth focused 'how-to' guides

- Podcast interviews with seasoned entrepreneurs and investors

- Invitations to our exclusive webinars

- Ask questions to our expert Investor Panel